Assets

An Asset in ERPNext is anything or an item of value that a company owns and possesses, and one that would be able to yield economic returns in the long run. The assets of an organization are usually classified as either the tangible assets like furniture, machine, vehicle and computers or the intangible assets like software license, patents and trademarks.

Assets in most instances are tangible items either on company premises or allocated to employees for use in operations. Some examples include office desks, laptops, printers, or cars used for business transport. ERPNext also accommodates intangible (non-physical) assets that have value and must be capitalized and monitored in the books of account.

Assets typically have a useful life extending over several financial years, i.e., they are not used up in the year acquired. Account-wise, the asset cost is capitalized and the asset is depreciated over time. For instance, if a business buys a printer for $300 with a useful life of 3 years, ERPNext will charge $100 of depreciation expense each year rather than writing off the entire $300 in the initial year. This is according to accounting principles and legal requirements in most jurisdictions.

In ERPNext, the Asset master is the primary entity of the Asset Management module. It records all the important information and transactions across the asset life cycle — from acquisition and depreciation, movement, maintenance, disposal, sale, or scrapping.

Navigation

To list or manage assets in ERPNext, go to:

1. Prerequisites

Before adding an Asset record, make sure the following setup steps are completed:

- Item and choose the box 'Is Fixed Asset', which distinguishes the item as a fixed asset, not a stock item or consumable.

- Asset Category to group together similar assets and establish general accounting principles, such as depreciation of such assets and associated ledger accounts.

Note: Also Maintain Stock is not applied on fixed assets as they are not listed in the inventory as stock item.

2. How to Create an Asset

To add an Asset in ERPNext:

- Create an Item Master:

- Go to Stock > Items > Item.

- Establish the item name and description (e.g., "Office Chair", "Laptop").

- Deselect 'Maintain Stock' to not include it in inventory valuation.

- Mark 'Is Fixed Asset' as the identification of an asset.

- Create the Asset Record:

- Go to Assets > Asset > New.

- Choose the Item and enter the appropriate Asset Category and include such other details as the date of Purchase, Purchase Invoice Entry, Location and Employee/User assignment.

- Provide financial information in the form of purchase cost, useful life, and available-for-use date.

- Allocate depreciation and accounting configurations, either manually or automatically via the related Asset Category.

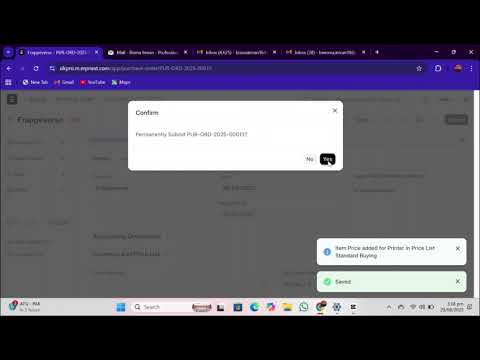

- Save and Submit the asset. ERPNext will automatically:

- Create depreciation schedules (if enabled),

- Execute respective general ledger postings (if accounting integration is included),

- Track other activities like asset movement, maintenance, and disposal.

By maintaining accurate and trustworthy asset records in ERPNext, business firms can have better control of physical assets, ensure financial compliance, and supply inputs for investment and replacement planning.

2.1 Auto Creation of Assets

ERPNext provides the handy feature of auto creation of asset records when a Purchase Receipt is made. This significantly streamlines asset management by avoiding manual entry and timely tracking of newly acquired fixed assets.

To enable this feature, you must enable the option 'Auto Create Assets on Purchase' in the Item master of the asset. This way, ERPNext will create an associated Asset record automatically from the transaction information every time this item is received through a Purchase Receipt.

Once auto asset creation is enabled

- When requisitioning the Purchase Receipt, the system will prompt for other mandatory fields, such as the Asset Location, and in some cases, employee or department assignment, depending on the item setup.

- One or more Asset records will be created by the system, based on the quantity received. That is, if 5 laptops are received, 5 different asset records will be created with various Asset IDs and associated with the same purchasing document.

ERPNext will use the values from the Purchase Receipt — i.e., purchase date, supplier, purchase rate, and company — to populate the corresponding fields in the Asset record. In case the item has a linked predefined Asset Category, default depreciation rules, accounts, and finance book configurations would similarly be automatically applied from the category.

After being successfully posted the Purchase Receipt, ERPNext will display a successful message that the asset(s) have been created.

You can then see the created asset records under:

Note: The option is ideal in businesses where there are frequent purchase of fixed assets, say IT hardware, equipment or office set-up. It offers standardization about record- keeping, simple monitoring of depreciation, and reduces the likelihood of missing capitalization.

2.2 Manual Creation of Assets

Where asset creation needs to be controlled manually or customized, ERPNext provides you with the facility to manually create Asset records after an item is procured. This option is especially useful in areas where each asset will have varying metadata, serial numbers, or location information which is not standardized or even appropriate for auto-creation.

To create assets manually, ensure that the Is Fixed Asset box of the product Item master is selected and that the Auto Create Assets on Purchase option is not selected. When you add such an object to a Purchase Receipt or Purchase Invoice, ERP Next will warn you with a notification that you need to manually add an asset to the transaction.

Steps to Manually Create an Asset:

Go to: Home > Assets > Assets > New

Enter Asset Name: Enter a distinct and recognizable name for the asset (e.g., "MacBook Pro - Marketing Dept").

Select the Item Code: The respective Item Name and Asset Category (referenced against the Item master) will be auto-retrieved after being selected.

Assign Asset Owner: Select the relevant owner type:

- Company (default for in-house use),

- Supplier (in situations such as leased property),

- Customer (for assets based at customer sites).

Choose the Owner Entity: Select the appropriate Company, Supplier or Customer based on the type of owner.

Link the Purchase Document: Choose the Purchase Receipt or Purchase Invoice out of which the asset is bought. ERPNext will automatically fill the purchase date and gross purchase amount on the document.

Specify Asset Location": Give the **physical location of the asset (e.g., "Mumbai Office", "R&D Lab – Floor 2"). If the location was established earlier in the item row of the Purchase Receipt, it will be automatically filled in.

Fix the Available-for-Use Date: This date is the point the asset is available to be used. Depreciation will begin from this date, and for this reason it is important for accounting purpose.

Save and Submit the asset record. When submitted, ERPNext will create the depreciation schedule, associate accounting entries (if accounting integration is turned on), and make the asset eligible for subsequent actions such as maintenance, movement, or scrapping.

Important Note: If you've bought multiple units of an asset (5 laptops in one Purchase Receipt), ERPNext won't create multiple Asset records automatically when using the manual approach. You need to manually create an individual Asset record for each unit, even though they were bought in one single transaction.

Example:

- Purchase Receipt for 5 Dell laptops

- You need to create 5 separate asset records — one for every laptop — with possibly different names, serial numbers, and locations.

Manual asset creation provides the organization with more freedom and control enabling organizations to customize asset tracking to instances that need complicated configuration. It is best when every asset needs to be hand tracked, assigned, or identified across departments.

2.3 Creating Composite Assets

In ERPNext, you can create a Composite Asset when an asset is made up of multiple individual components or pieces that are purchased and booked separately but utilized as a single operating unit. This is ideally for complex assets such as computer workstations, lab environments, or custom machinery, where items like a monitor, CPU, keyboard, and UPS are purchased separately but need to be booked as a single capital asset.

To make a composite asset:

- Mark the 'Is Composite Asset' checkbox during parent asset record creation (e.g., "Computer System – Finance Dept").

- When you get component items through Purchase Receipts or Purchase Invoices, mark each item with the WIP Composite Asset field, choosing the composite asset you just created. This links those items as components to the parent asset.

- The system capitalizes these items as in construction or assembly and temporarily holds their value in the Capital Work in Progress (CWIP) account.

- Once you have all necessary items/components and have the asset ready for use, you can capitalize the composite asset with the assistance of the Asset Capitalization feature. This will:

- Shift the cumulative amount of all related items to CWIP into the Fixed Asset account,

- Start depreciation scheduling,

- Convert the composite asset into an active and depreciable asset within the system.

This approach offers more flexibility for tracking, constructing, and capitalizing assets that are not acquired as an aggregate unit but operate together operationally.

2.4 Importing Existing Assets

The transfer of your current asset base is required when migrating a legacy ERP or accounting system to ERPNext, to maintain depreciation, financial reporting and audit compliance continuity. ERPNext simplifies the migration process because it allows the immediate entry of the available assets with their prior depreciation data.

To import an existing asset:

- Visit Assets > New, and activate the checkbox "Is Existing Asset". This means that the asset was bought in the past and is already existing.

- Enter the following historical and financial information:

- Gross Purchase Amount: Initial purchase price of the asset.

- Purchase Date: Original date of acquisition of the asset.

- Available-for-use Date: The date that the asset was originally put to use (used to calculate the beginning of depreciation).

- Opening Accumulated Depreciation: The aggregate depreciation already charged prior to migration.

- Number of Depreciations Booked: Number of depreciation periods already booked before the migration date.

- Is Fully Depreciated:Number of depreciation periods already carried to the books anterior to the migration date. Check this in case the asset already passed its useful life and there is no more book value left.

Once this is inputted and pressed to submit the asset, ERPNext will:

- Calculate the remaining depreciable amount (as the case may be),

- Automatically generate a new depreciation schedule since the date of migration up to date.

- Carry on with depreciation utilizing, residual value, remainder useful life.

This attribute guarantees that financial information is consistent and compliant after migration, and prevents companies from loss of historical depreciation or misstatement of asset values.

2.5 Additional Options while Creating an Asset

While creating an Asset record in ERPNext, there are several optional fields that add asset tracking, improve accountability, and provide accurate reporting. These fields help you associate the asset with specific personnel, organizational units, and control depreciation behavior.

2.5.1 Custodian

The Custodian is the person or the worker who possesses the physical custody and care of the asset. The presence of a custodian is a guarantee of accountability, particularly in assets that have the characteristic of portability or are intended to be used individually such as laptops, mobile phones or equipment. Once this person is assigned, he/she is the one who will undergo audit, movement, or service.

Example: If a laptop is allocated to a marketing department employee, choosing that employee as custodian will assist in tracking responsibility.

2.5.2 Department

This field enables you to associate the asset with the Department of the user or custodian. It supports cost center-based allocation, departmental audits, and distribution of assets reporting. Departments may also be utilized to filter or segregate depreciation and asset use reports for multi-department organizations.

For example, a projector belonging to the "Training Department" can be tracked independently of assets belonging to "Sales" or "IT Support".

2.5.3 Calculate Depreciation

Depreciation of any fixed asset will be computed by default in ERPNext unless specified otherwise. This behavior can be controlled with the checkbox Calculate Depreciation:

- Activate this option if the asset is depreciable and ought to have a scheduled depreciation life cycle.

- Turn it off for non-depreciable assets (like land, heritage equipment, or artwork), or when depreciation is calculated manually or outside of Knowledge.

Turning off this field will bypass the automatic creation of a depreciation schedule for the asset, even if a depreciation method is set up in the Asset Category.

These additional fields provide more control, transparency and granularity when dealing with assets in ERPNext. Their use introduces more effective organization asset tracking, allocation, and lifecycle management to the organization.

3. Features

3.1 Depreciation

In ERPNext, depreciation is a central functionality of the Asset Management module, which allows accurate accounting for an asset's cost over its useful life. Depreciation enables the actual value of assets to be represented on financial statements and ensures compliance with accounting standards.

Depreciation setup is very flexible and can be tailored to fit any business as well as statutory requirements. The depreciation is posted and scheduled by ERPNext based on the settings at the time of creating an asset or on the asset category in which it is created.

Following are the primary fields and characteristics of depreciation in ERPNext:

3.1.1 Depreciation Frequency (Months)

This parameter specifies how frequently depreciation is posted. For instance, the value 12 will post depreciation every year, whereas a value of 1 allows every month depreciation. This will help companies match depreciation schedules with book periods, i.e., quarterly, annual, or monthly.

3.1.2 Total Number of Depreciations

Defines the number of depreciation entries to be entered throughout the useful life of the asset. This number is used to create the depreciation schedule. For assets already being held which have already been depreciated partially, put in the number of depreciations remaining instead.

Example: If an asset is having a frequency of 12 months and 3 depreciations total, ERPNext will post an entry for depreciation every 12 months for 3 years.

3.1.3 Depreciation Method

ERPNext has four different depreciation methods, and organizations can choose according to internal policy or local requirements:

- Straight Line: Depreciation amount the same for every period.

- Written Down Value (WDV): Depreciate a fixed percentage of the book value remaining for every period.

- Double Declining Balance: A method of accelerated depreciation where assets depreciate faster in the initial years.

- Manual: Custom scheduling and entry of depreciation amounts are allowed.

You may set up default methods in the Asset Category, and override them by asset if necessary.

3.1.4 Depreciation Posting Date

It is the date from which ERPNext starts posting and calculating depreciation entries for the asset. It will usually be after the Available-for-Use Date, but you can configure it to manually match financial periods.

3.1.5 Expected Value After Useful Life (Salvage Value)

This is the approximate value of the asset remaining at the end of the useful life of the asset -the value that can be obtained by selling the asset or scraping. Scrap Value, Residual Value, or Salvage Value is also referred to as such.

If this field is defined, ERPNext will make sure that the total depreciation booked will not make the book value of the asset lower than this value.

3.1.6 Salvage Value Percentage

Rather than typing in a salvage value, you may type in a percentage of the Gross Purchase Amount, and ERPNext will calculate automatically the Expected Value After Useful Life.

For instance: If the cost of purchase is \$10,000 and the Salvage Value % is 10%, ERPNext will automatically set the Expected Value After Useful Life at \$1,000.

3.1.7 Rate of Depreciation

This rate is automatically determined using the useful life of the asset and the salvage value that is expected to be generated more so in the Straight Line and WDV methods. You can check or change this figure as required by statute, or by internal policy.

3.1.8 Finance Book

ERPNext allows keeping multiple Finance Books for reporting depreciation under different rules for statutory, internal, or tax purposes. Depreciation entries can be posted to each asset against one or more finance books, with parallel reporting under various regulations.

3.1.9 Depreciate Based on Daily Pro-Rata

When this setting is activated, depreciation is computed on a daily basis as opposed to per period. What this does is that shorter months (e.g., February) will have proportionately smaller depreciation entries in comparison to longer months (e.g., July).

This handling gives proper depreciation tracking, especially useful in entities that utilize actual-use-based accounting.

3.1.10 Depreciate Based on Shifts

There are also other organizations whose assets work at varying shift periods (e.g., factory machines) and depreciation can be made on the basis of the amount of use. ERPNext supports the concept of shift-based depreciation meaning that the rate or value is determined by the quantity of shifts works by an asset.

To implement this:

- Create Shift Factors through the Asset Shift Factor Doctype. For instance:

Make the default shift when creating the asset.

If shifts change over the life of the asset, use the Asset Shift Allocation Doctype to change the shift for certain periods. ERPNext will update the remaining depreciation schedule appropriately.

This is particularly applicable to assets with wear and tear or value consumption that is usage based rather than time based.

Using the complete depreciation module included with ERPNext, organizations are able to maintain a precise valuation of their assets, adherence to accounting principles, and more detailed control of the accounting reporting.

3.2 Depreciation Schedule

As soon as depreciation is configured and begins to get applied against an asset, ERPNext generates a Depreciation Schedule for the asset automatically. This is made available in the section within the Asset record once initial depreciation entries are booked.

The Depreciation Schedule indicates tabular overview with the following emphasized key columns:

- Finance Book: Indicates the book on which the depreciation will be accounted (e.g., Statutory, Internal, Tax).

- Schedule Date: The date when each depreciation posting is scheduled to be done.

- Depreciation Amount: The calculated depreciation figure for that period.

- Amount Depreciated: Accumulated running total of depreciation booked so far.

- Journal Entry: Refers to the automatically created journal entries, for traceability in the general ledger.

The schedule automatically updates if there have been any changes in the configuration of the asset, for example, shifts, revaluation, or pre-termination. You can regenerate the schedule too.

3.3 Insurance Details

With ERPNext, an insurance record of all assets is maintained, including the ability to track coverage, expiration and policy documents. This would be particularly useful in use on high-value or movable assets such as cars, machinery, or equipment that is located at customer sites.

While creating an asset record, you can add the following insurance fields:

- Policy Number: The insurance policy's unique identifier.

- Insurer: The insurer's name offering coverage.

- Insured Value: Value for which the asset is insured (perhaps not book value).

- Insurance Start Date and End Date: Date on which the insurance is in force.

- Comprehensive Insurance: A switch to indicate whether the insurance includes basic and extended risk.

They ensure a timely renewal, claim readiness and better risk management especially when an audit or loss of the asset occurs.

3.4 Accounting Entries

ERPNext has close integration with the Accounting module, and the correct accounting entries are automatically generated on asset submission.

- When an asset is submitted, ERPNext creates a journal entry that credits the "Capital Work in Progress (CWIP)" account and debts the concerned Fixed Asset account, technically capitalizing the asset.

- This transaction makes the asset show up on the balance sheet of the company as a capitalized item instead of an expense.

- But submission is only available after setting the "Available-for-Use Date".

- When the available-for-use date is in the future, ERPNext automatically schedules the accounting entry to be posted on that future date via the background scheduler. Manually, nothing needs to be done.

This provides correct financial accounting as per global accounting standards (e.g., IFRS, GAAP), with cost recognition linked to preparedness of assets.

3.5 Maintenance

ERPNext offers the end-to-end maintenance process to monitor the servicing, inspection, and repairing of the physical assets.

- By marking the checkbox 'Maintenance Required' in the asset record, you facilitate logging of Asset Maintenance records for the item.

You can track these maintenance records for:

Scheduled preventive maintenance

- Corrective repairs

- Service history

- Technician details and costs

This option is particularly useful for machinery, vehicles, and infrastructure where preventive maintenance cuts downtime and prolongs asset life.

You are able to view additional information and workflows under: Home > Assets > Asset Maintenance

3.6 After Submitting an Asset

Once an asset is entered, ERPNext can provide a list of activities that can be performed via the asset dashboard. These assist in the maintenance of the asset until it is fully utilized and 3.until its useful life. The critical post-submission activities include:

- Transfer: Move the asset to another location, department, or employee by creating the Asset Movement Doctype.

- Scrap: Mark the asset as obsolete and update its book value.

- Sell: Enter the sale of the asset and automatically calculate gain or loss on disposal.

- Adjust Value: Change the book value of the asset because of revaluation, impairment, or upgrades.

- Depreciation Entry: Manually enter or adjust depreciation entries if necessary.

All these actions are available from the "Make" button on the asset record for smooth asset lifecycle management.

Video Tutorial

Click below to open the "Video"